Alleviating the Stress of Tax Season

For California-native Emily Wang ’26, one of the hardest parts of her first year at Babson has been navigating Soldier’s Field Road. The parkway in Boston, which rides along the Charles River, connects neighborhoods to Storrow Drive and nearby schools Boston University and Harvard University. But, for unseasoned New England drivers, the cons may outweigh the pros.

“The roads (in Boston) are kind of wonky,” Wang says. “It’s different driving here. It’s a different experience.”

The universally reviled experience of driving in Massachusetts is stressful for a lot of out-of-state Babson students. Wang, who admits to once missing her exit twice on her drive to the Josephine A. Fiorentino Community Center in Lower Allston, is mastering this skill as part of another new experience: her role as a manager in Babson College’s chapter of the Volunteer Income Tax Assistance (VITA) program.

Filing your taxes, especially when you’re unfamiliar with the process or have a language barrier, can be just as nerve-wracking and annoying. VITA is a federal program that provides free tax return preparation to qualified individuals and families, including low-income individuals, people with disabilities, and people who need English assistance.

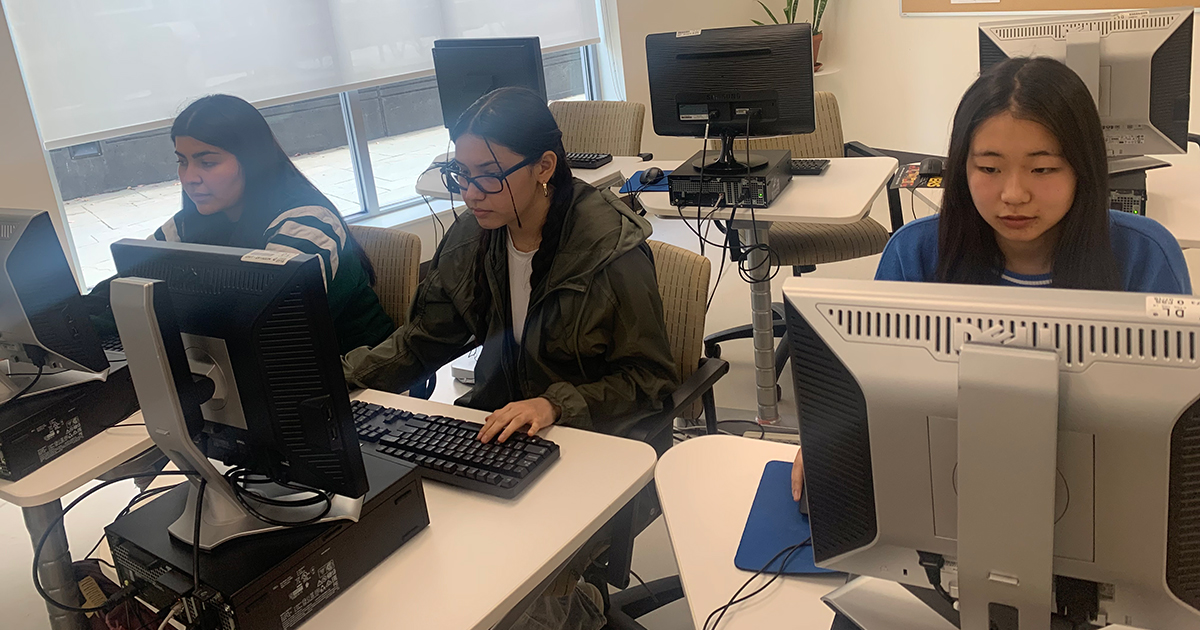

On the weekends during tax season, students brave the parkways of Boston to not only put their Babson training to the test but also help these communities feel a little less stress as tax day approaches.

“When you have people come in, they may not know the tax process, how the filing happens, where the money is going,” Evan Kisselev ’24 says. “There’s a lot of anxiety and stress surrounding these official government processes. Being able to walk someone through this process and seeing the relief that they have and the stress going down is quite rewarding.”

More Than Just Accounting

Annually in December, about 20 to 30 Babson undergraduate students such as Wang and Kisselev are trained in federal and Massachusetts tax code. After a seven-hour course and two exams, even if they’ve never taken an accounting course, they are ready for tax season.

Babson has offered VITA volunteer opportunities for students since 2008 and now, as part of the Institute for Social Innovation within the Arthur M. Blank School for Entrepreneurial Leadership, has been working with the Community Financial Management Program since 2018. The students help participants fill out their intake forms and sort through their tax documents, as well as review completed tax returns a certified public accountant (CPA) completes.

“There’s a lot of anxiety and stress surrounding these official government processes. Being able to walk someone through this process and seeing the relief that they have and the stress going down is quite rewarding.”

Evan Kisselev ’24

“The idea is to have real-life experience with the skills they are learning in the classroom while also serving the local community,” says Joshua Stevenson, the associate director for social impact and sustainability at the Institute for Social Innovation.

Though about half of the program’s participants are accounting students, Stevenson says it appeals to anyone interested in community service and learning a new skill.

Because of the training, no tax experience is necessary. Students find that other skills, such as the teamwork and problem solving they learn in Foundations of Management and Entrepreneurship (FME) and foreign language proficiency, come in handy just as much. Kisselev, who speaks English and Russian, says he feels a sense of pride when he can help other Russian speakers understand taxes better.

A Professional Playground for Young Students

Each shift has CPAs on site to ensure the returns are done properly, and they are a resource for students, especially if they are anxious about taking on such important work. Many of the students are in their first and second years, and the program is an introduction to taking what they have learned outside of the classroom into a professional environment.

“When I first started working, I felt troublesome. There are a lot of things I didn’t know, and I kept asking questions,” Wang says. “I felt like I learned quickly because of how willing they are to help us.”

It’s a controlled, sandbox-like environment that provides both hard accounting skills and soft skills, such as team building, situational awareness, and dependability. Students are learning how to show up for shifts, the value of finding pride in their work, and even how to handle confidential information. As a manager, Wang is responsible for transportation as well as personal concerns and scheduling during her shifts.

“It’s building on my personal value of helping others and community service. It helps with personal growth, not just academics. You’re developing your character.”

Emily Wang ’26

For Kisselev, who is pursuing the accounting concentration at Babson and will be interning in the Boston offices of PwC this summer, he has seen firsthand how employers value this type of hands-on community service.

“Even if this summer I won’t be working on personal income taxes, knowing the forms, knowing the filing process, will help in my internship,” Kisselev says. “From talking to employers in the interview process, they definitely care about this program. Every interview I’ve had has asked about this program. They value seeing the leadership and teamwork that come with this experience.”

Stevenson says the Big Four accounting firms (PwC, Deloitte, Ernst & Young, and KPMG) will usually ask about students’ participation in this program if their school offers it.

While any situation that brings classroom learning into a real-life situation provides professional development, for Wang, Kisselev, and the other volunteers, there’s also a sense of personal pride that makes the drive on the wonky streets of Boston worth it.

“It’s building on my personal value of helping others and community service,” Wang says. “It helps with personal growth, not just academics. You’re developing your character.”

Posted in Community