What Is a Stock Split? 3 Things to Know

If you’ve kept as much as a slight eye on the stock market over the past month, then you’re likely well aware of how Apple’s and Tesla’s stocks have popped.

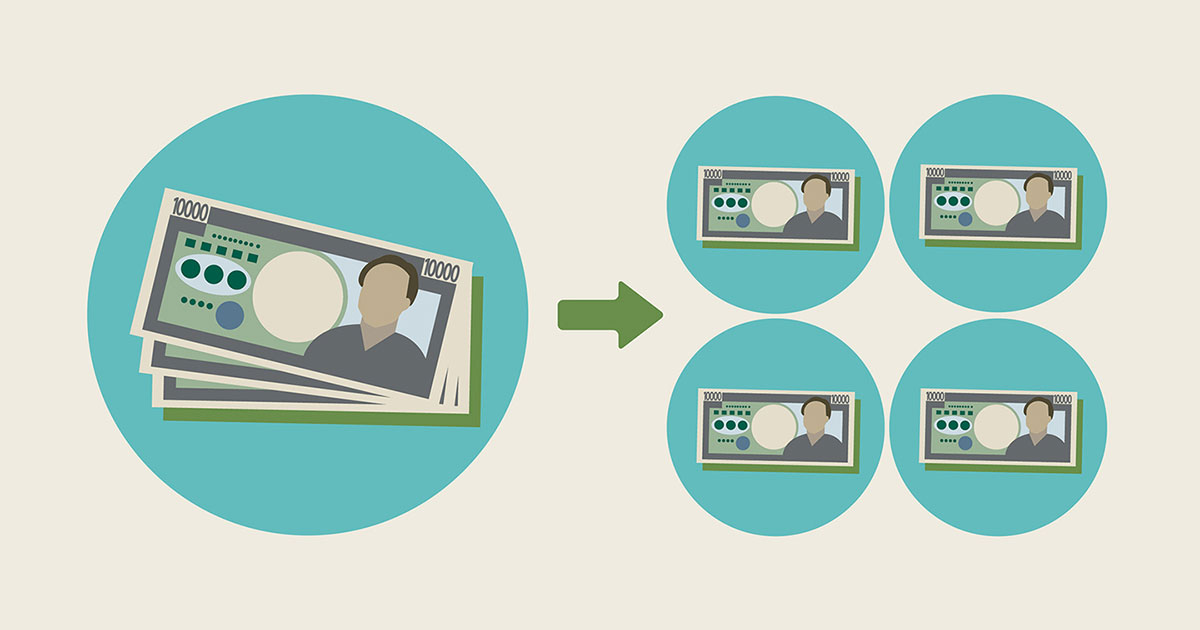

On Friday, August 28, shares of Apple and Tesla closed at close to $500 and more than $2,000. Come Monday, those same companies were selling shares for $127 and $444, following 4-to-1 and 5-to-1 stock splits, as part of a move to increase accessibility.

“Historically, companies have split their shares when the stock price was above a desired level,” Professor of Finance Laurie Krigman said. “If a stock was priced high, say above $100 per share, it would be seen as a barrier for individual investors to invest in a company.”

What Is a Stock Split?

By splitting a stock, a company may hypothetically take a $100 share and split it into two $50 shares. “It is a mechanical transaction that in theory should have no impact on value,” Krigman said. “The shareholder’s wealth does not change.”

Why Do a Stock Split?

Some companies split shares when their stock price surpasses a desired level. Splits make it more affordable for more investors to purchase shares, “increasing the liquidity of the stock, making it easier and less expensive to trade,” Krigman said.

“Historically companies that split their stock have outperformed their benchmarks in the years following a split,” Krigman added. “Thus, investors perceive the decision of a firm to split their stock as an information event indicative of future outperformance.”

What Is a Reverse Stock Split?

In contrast, a company may pursue a reverse stock split when its stock price is too low and at risk of being delisted.

“This is typically a last-gasp effort by a firm that is in trouble to remain listed,” Krigman said. “While a normal stock split is indicative of good things to come, a reverse stock split signals tough times ahead.”

Babson Finance Students Are Passionate About the Stock Market

The Stephen D. Cutler Center for Investments and Finance offers numerous experiential opportunities to learn about the stock market, through courses like the Babson College Fund and opportunities outside of the classroom such as the College’s Stock Picking Competition and Trading Team.

Posted in Insights