The Rise and Future of Financial Innovation

For most internet and smartphone users, managing your money has never been easier. One can conduct transactions with Square, transfer money via Venmo, or keep close tabs on your credit score with Credit Karma.

Yet, financial technology will represent just a segment of future startups, said Bain Capital Ventures partner Matt Harris at Babson’s Centennial Celebration.

“Financial technology will be more like an ingredient people use to build their business, in the same way that 25 years ago we used to talk about internet companies,” Harris said. “No one talks about that anymore, because the internet is an ingredient you use to build your business.”

“What entrepreneurs need to realize [is that] in 10 years, we’ll surely be talking less about fintech companies, and more about financial technology as a monetization lever for technology companies of all types,” he added.

Odilon Almeida P’20, president of Western Union Global Money Transfer, offered a different opinion, stating there is still opportunity for financial technology innovation if an entrepreneur develops the right idea.

“For the students of Babson, if you really think you can disrupt the niche, there is still some value,” he said.

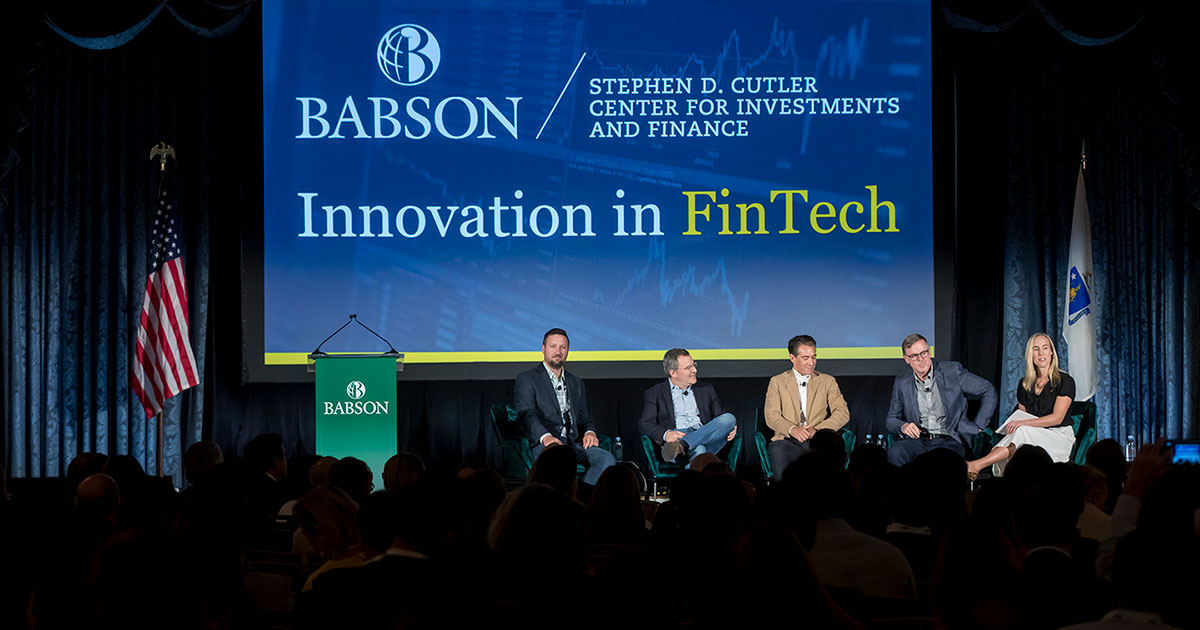

So, what role will the future hold for financial innovation? Harris and Almeida joined Philip Edmundson MBA’93, founder of Corvus; Jason Moens ’99, vice president of product at Flywire; Devon Sherman, director of MassChallenge FinTech; and Babson’s Stephen D. Cutler Center for Investments and Finance for an Innovation Through Finance panel at Babson Connect: Worldwide.

“It’s a really exciting time in fintech, we’re looking forward to sharing some trends we’re seeing in this space,” Sherman said.

The Rapid Growth of Financial Technology

Partnerships between financial startups and institutions have evolved with the sharp rise of financial technology after what was initially considered a challenging relationship due to financial institutions’ investment requirements, according to Harris.

“The banks, insurance companies, broker dealers—[they all] had to react,” Harris said. “They were driven to say, ‘We may actually lose some market share,’ and they’ve become much better customers, much better partners, and are now legitimately interesting places to build a business.”

“What entrepreneurs need to realize [is that] in 10 years, we’ll surely be talking less about fintech companies, and more about financial technology as a monetization lever for technology companies of all types.”

Matt Harris, Bain Capital Ventures partner

In terms of facilitating financial technology innovation, countries have reacted differently. Almeida referred to Egypt and China as innovation hubs and said the U.S. government needs to do more to aid innovation.

“The United States has everything. Tremendous amount of capital, has education, entrepreneurship … the part that is missing is some government facilitation,” Almeida said. “I look forward to the day where it’s not going to be about regulating and telling what’s wrong, but it’s going to be about facilitating.”

Where Else Will Future Opportunities Be?

Flywire’s vice president of product, Jason Moens ’99, says machine learning has potential to drastically alter areas of financial technology, and he provided the lending space as an example.

“There’s very few firms that are straight up decisioning on FICO credit scores anymore,” Moens said. “Everybody is doing that with their own internal algorithms and augmenting that with better data.”

“You see a trend coming along; if you can see where it’s going, you’ll see how it becomes an essential part of a huge industry,” added Corvus founder Philip Edmundson MBA’93. “That’s part of the change that I think is fun and challenging for all of us here.”