Entrepreneurial Women Need Disruptive Financial Models

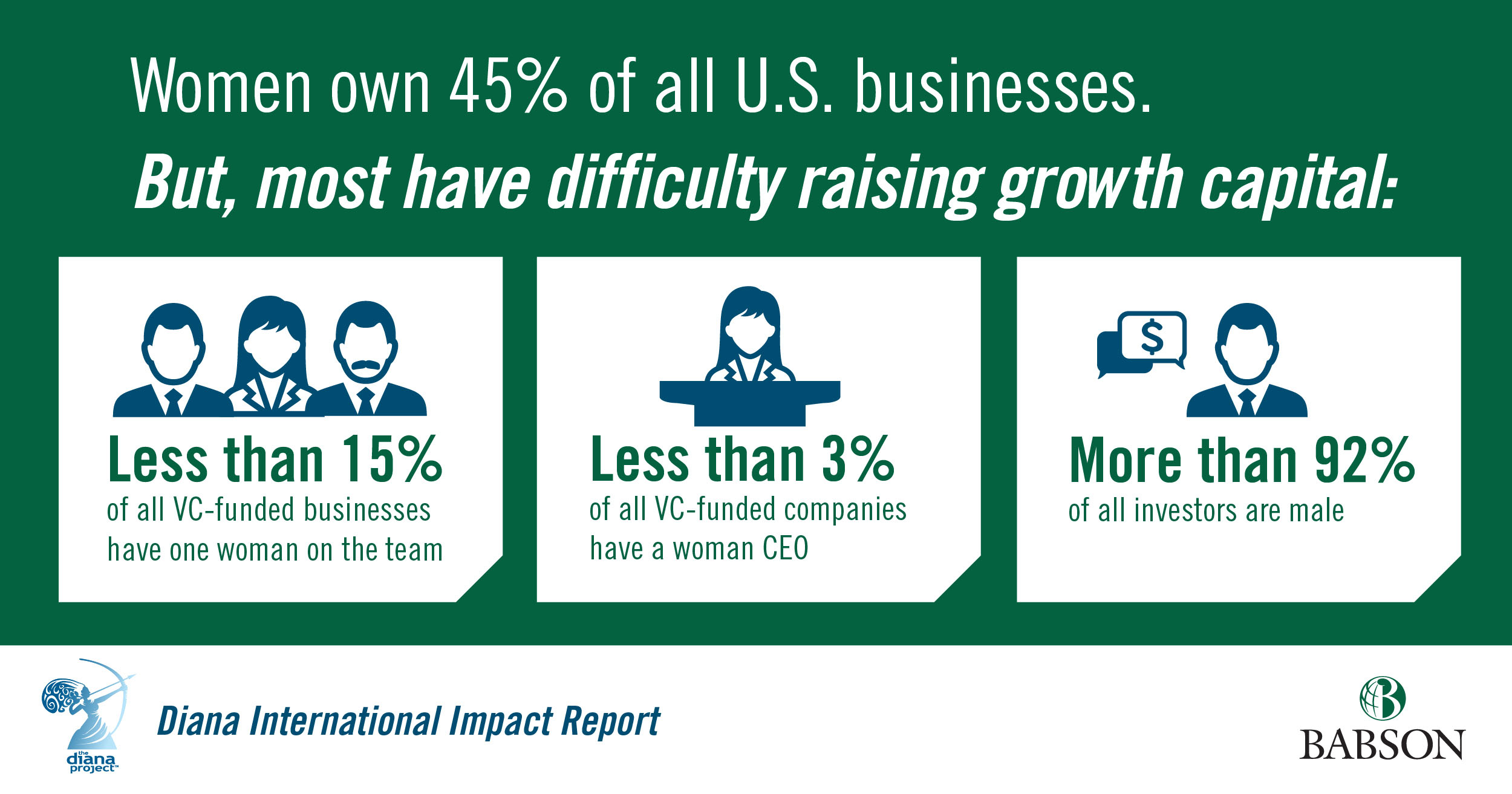

Entrepreneurial women are a significant force in the U.S. economy, now equal or majority owners of 45% of all U.S. firms.

Yet, most have difficulty raising growth capital, and new models of funding are needed, according to the new Diana International Impact Report.

“We need to create and support new models of funding for women entrepreneurs because their access to growth capital is a serious and continuing problem,” says Diana International Impact Report co-author, Babson Vice Provost of Global Entrepreneurial Leadership Candida Brush.

Less than 15% of all VC-funded businesses have one woman on the team, less than 3% of all VC-funded companies have a woman CEO, and more than 92% of all investors are male, according to the most recent Diana Project™ research.

“Investing in women entrepreneurs is an opportunity to expand innovation and economic development. We should create a new reality for the process and benefits of investing in women entrepreneurs,” said co-author and Babson Entrepreneurship Professor Emerita Patricia Greene, formerly director of the Women’s Bureau, U.S. Department of Labor.

This call for new funding models for entrepreneurial women and documentation of the continued disparity in funding by gender is reported in the new Diana Report. It advocates a new funding direction by identifying disruptive funding models and best practices for women entrepreneurs across each of the six primary processes that drive entrepreneurial development: identifying, training, connecting and sustaining, funding, enabling public policy, and celebrating.

Identify

The report calls for refinement of the pipeline processes that already exist and the creation of new funding models for entrepreneurial women that differ from the conventional VC model.

Train Investors

Training women investors can open the funding tap to allow a new flow of capital into women-owned and -led businesses and a growing number of companies.

Examples of training vehicles include 500 Startups, which offers VC Unlocked as an executive education program for those who want to learn “how Silicon Valley really works,” and 37 Angels, which is building a community of women investors with a mission of educating early-stage investors.

Connect and Sustain

Accelerators focusing on women founders provide opportunity for female entrepreneurs to access resources, including their networks, thereby increasing chances of accessing growth capital in the future.

Approximately 30 women-focused, startup accelerators and incubators in the U.S. provide training, support, and funding, including the Women Innovating Now (WIN) Lab® at Babson College, Aviatra Accelerators, Founders for Change, The Riveter, and The Wing.

Fund

Venture capital firms need to hire more female decision-making investors.

There needs to be intentional action by the top venture capital firms to reach outside their current network into other networks to acquire female investors.

Additionally, new funds are growing a more inclusive focus on both the supply and demand side—more women providing the funds and more women receiving them. This both expands the number of women investing and potentially diversifies the types of businesses selected for investments. Examples include Victress Capital, XFactorVentures, Portfolia, Golden Seeds Venture Fund, and Plum Alley.

Public Policy

Advocacy organizations, including the National Women’s Business Council, are catalyzing new ideas, encouraging change and providing policy support to address diversity, startup, growth, and funding of high-growth women entrepreneurs with a range of definitions of what constitutes a successful outcome.

Celebrate

It is important to celebrate, advocate, and provide visibility for accomplished women entrepreneurs, funding successes, and outstanding performance.

Storytelling becomes a vehicle for creating role models and giving women confidence and permission to grow and scale. One such initiative includes collaborations between Estee Lauder Companies, Nordstrom, UGG, and Williams-Sonoma Inc., which are realizing the power of partnerships by coming together to raise the profile of women leaders across global supply chains through the “This is a Leader” campaign, coordinated by Business for Social Responsibility’s HERproject. The Tory Burch Foundation also is a major catalyst in amplifying the visibility of women entrepreneurs through its Embrace Ambition series and corresponding Ambition Stories campaign.

The report was sponsored by the Center for Women’s Entrepreneurial Leadership (CWEL) at Babson College and was developed during the June 2019 Diana International Impact Day event hosted by Babson College.