A Profile of Omidyar Network

Omidyar Network was born in reaction to the standard model of philanthropy. Pierre and Pamela Omidyar founded eBay in September 1995. Less than four years later, their share of the now-public company was worth $3 billion, and they had passed the reins of running the company to others. The head-snapping speed of their success, and its basis in an innovative idea, inspired the Omidyars to pause and consider a different model of philanthropy. Since 2004, Omidyar Network has committed more than $879 million in grants and investments. Investment is key to the new model: instead of simply giving money to accelerate social good, Omidyar Network behaves like a venture capital firm, investing in global businesses whose result is public good.

Why It’s Different

A pioneer in social venture investing, Omidyar Network positions its investments in entrepreneurial ventures that are too small to interest banks, yet too big for microfinance services such as Kiva.

Who Is Helped

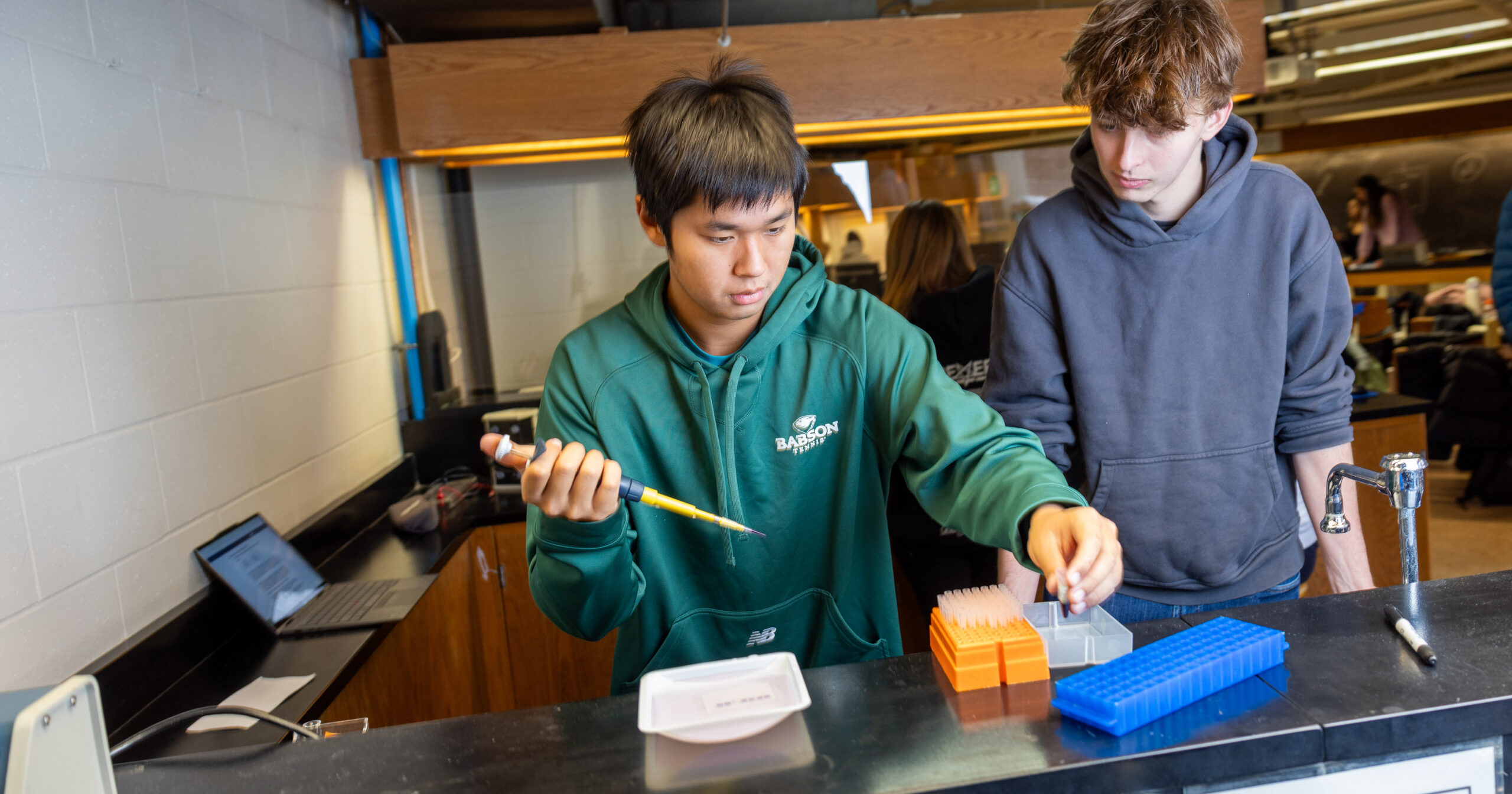

Omidyar Network invests in enterprises that promise significant social impact in their communities. This includes for-profit businesses such as d.light design, a maker of solar-powered lighting devices that can be affordably bought in the world’s poorest countries; foundations such as Ashoka (Babson received Ashoka’s 2011 Social Innovators Award and is an Ashoka Changemaker partner); and nonprofits focusing on entrepreneurship such as Teach for India.

Why It Matters

Accountability. When the Omidyars considered starting a foundation, they saw that gifts to charitable organizations, while gratefully received, couldn’t be traced directly to results, as investments in businesses are traced. The model of investing in social change organizations requires that measurable good flows from the investment, just as accounting methods tell executives whether a for-profit investment is producing profits.

Relation To Entrepreneurship

Entrepreneurship is the engine of change to Omidyar, and is one of its five core initiatives. One-third of Omidyar Network’s staff of professional investors includes entrepreneurship as a focus for investment opportunities. In its financial statements, Omidyar Network states that its purpose is to support market-based approaches to catalyze economic and social change.

What This Means For Social Entrepreneurs

Socially accountable investing raises the stakes for producing results. Pierre Omidyar says, “There’s something about an entrepreneur that’s anti-establishment and somewhat disrespectful of the previous generation.” This was Omidyar Network’s guiding spirit from the beginning: that the previous generations of foundations, noble as their causes were, lacked the accountability to the end user that social investing demands.

Image courtesy of Teach for India