Fighting the Gender Investment Gap

Picture this. A twin brother and sister have the same education, get similar jobs, and save at the same rate for the same period.

Because the sister earns considerably less than her brother (especially if she is a Black or Hispanic woman), and would therefore only be able to invest a fraction of what her brother can, the sister can expect to accumulate up to 61% less in retirement savings than her brother.

This number can extend into the millions.

The Gender Investment Gap

Here, we have the gender investment gap—yet another issue that is a direct result of the gender pay gap. Luckily, some entrepreneurs have taken notice.

Sumeit Aggarwal MBA’05

Sumeit Aggarwal MBA’05 came to Babson because of its entrepreneurship ranking. She was determined to hone her already entrepreneurial mind in order to pursue her own enterprise. Little did she know that she would create a venture to empower women to take control of their financial futures.

In 2017, Aggarwal and her husband seized an opportunity to create change in their community and launched Finhive.

Talking to parents as their own kids got older, they realized that children aren’t taught about money in school. “I was lucky,” Aggarwal says. “Money was an open topic at my house and my mother regularly took me to the bank and taught me about financial independence.”

She quickly learned that kids weren’t the only ones dealing with a lack of financial knowledge. Her female friends, particularly those recently widowed or going through a divorce, expressed interest in learning how to save and invest, ultimately wanting to take control of their finances.

“Women are told from an early age that they don’t need to worry about numbers,” says Aggarwal. “Research tells us that as girls get older they drop out of STEM classes, despite performing just as well as boys. Today, we see major initiatives focused on increasing girls’ interest in STEM. I want to see that happen in finance as well.”

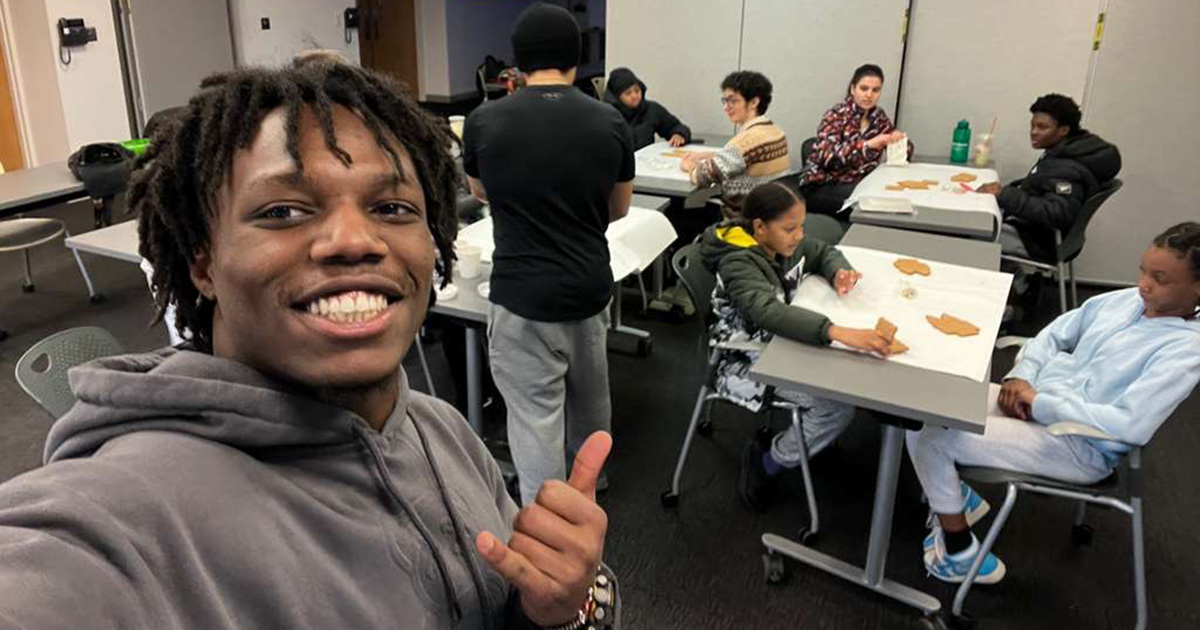

Teaching middle school kids summer classes like “Barter to Bitcoin,” Aggarwal typically has only one or two girls sign up comprising about 10% of the class.

Empowering Women to Invest

Those not taking advantage of the stock market are missing out, according to Aggarwal, which is a big percentage of the population. That’s why she has started investment workshops, classes, and even social gatherings for women to learn and ask questions.

“These are very smart women who have been left out of the financial conversations. They just need to know where to start,” says Aggarwal.

Here are five steps Aggarwal recommends to take control of your financial future:

- Learn to Fish: Don’t just hire someone to do the investing for you, learn about it yourself and take action.

- Set Your Goals: Decide what you’re trying to accomplish and make that goal clear. Whether it’s buying a new car or saving up for retirement, if you don’t have a goal, you won’t have anything to work toward.

- Know Your Risk Tolerance: Understand what kind of growth you’re looking for and what you’re willing to risk to try to achieve that growth.

- Find a Financial Planner: Planners aren’t always intimidating. Find someone whom you like and go from there. Need help vetting them? Head to finra.org.

- Regularly Flex Your Investment Muscle: Learning about finance and investing is like learning a new language. If you don’t practice, you won’t get stronger.

The gender wealth gap creates an estimated loss of human capital to the tune of $160.2 trillion globally. While the international community works to fix that gap, investing is one way that women can take steps toward doing it for themselves.

Posted in Entrepreneurial Leadership, Insights