Babson Helps Bridge Gender Gap in Investment Management

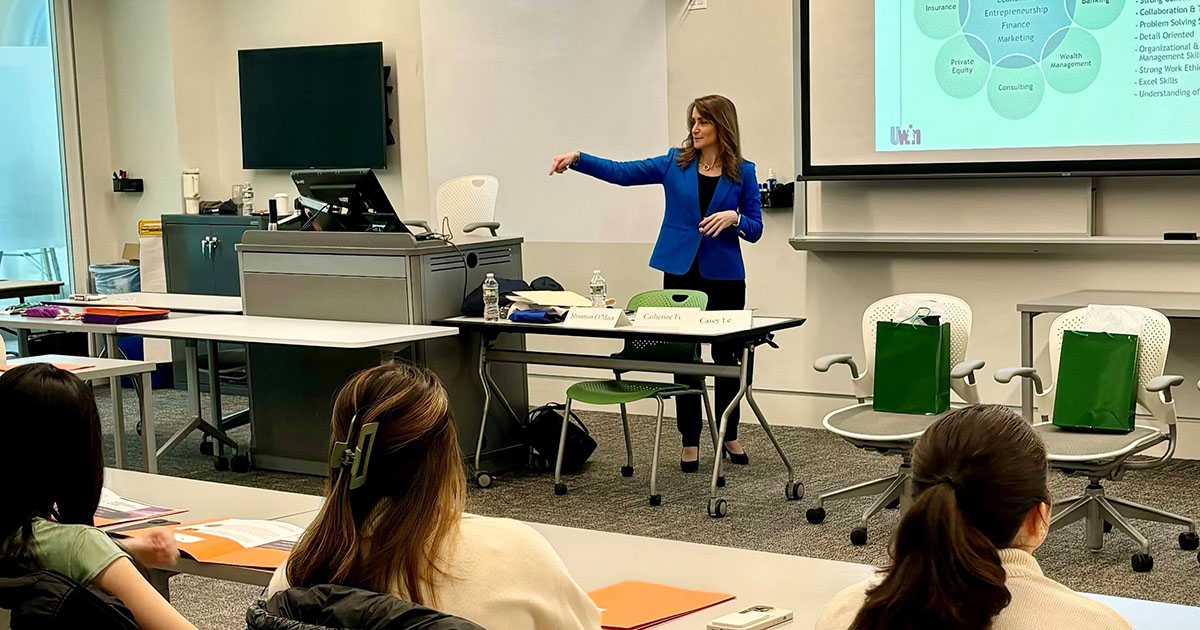

In the bustling heart of Boston’s financial district, a quiet revolution is underway, one started by Shannon O’Mara, associate director of credit research at Loomis Sayles, after she recognized a critical diversity gap within its applicant pool.

After spotting the issue, O’Mara embarked on a journey to reshape the future of the industry, one student at a time. So far, more than two dozen Babson College students have joined her.

“It all started back in 2014,” O’Mara said. “As I reviewed applications for entry- and junior-level positions for our team, I couldn’t help but notice a lack of diversity, particularly in gender representation. It was clear we needed to take action earlier in our recruiting efforts to increase the diversity of candidates down the road.”

Determined to address the issue head-on, O’Mara conceived an innovative solution: the Loomis Sayles Undergraduate Women’s Investment Network (UWIN) program. Her vision was simple—to inspire and empower undergraduate women to pursue careers in investment management.

“I knew these talented women existed at the undergraduate level,” O’Mara explains. “I just needed to show them that our industry was not only welcoming but also a place where they could thrive and make a meaningful impact.”

Diversity in Finance

Lillian Gofman ’25 is one of the many Babson students who have taken part in UWIN, which offers mentorships and paid internships.

“I have learned so much and made so many connections that I know will stay with me even after the semester ends,” Gofman said. “This internship is extremely unique in its emphasis on empowering young women in the investment management space.”

Now entering its 10th year, the program boasts a capacity for 50 students annually, each paired with a dedicated mentor—a vital relationship that O’Mara believes is key to their success.

“The mentorship component is crucial,” O’Mara said. “It’s not just about offering internships; it’s about providing comprehensive support and guidance throughout their academic and career journey.”

The program offers other resources such as workshops on technical skills and professional development to immersive internship opportunities that provide hands-on experience working with Loomis Sayles’ investment teams.

“We want these students to know that they’re not just doing data entry,” O’Mara explains. “They’re actively contributing to real projects that impact our business.”

One Mentorship at a Time

The results speak for themselves. Babson graduates of the program have gone on to secure positions at prestigious firms such as Loomis Sayles, Fidelity Investments, and JP Morgan Asset Management, embodying O’Mara’s vision of creating a more diverse and inclusive future for the investment management industry.

So far, 26 Babson students have participated in the program since applications began in 2020. Catherine Ferri ’20, for example, joined Loomis Sayles’ credit research team after her UWIN internship.

As O’Mara reflects on the program’s impact, she is filled with a sense of pride and optimism.

“It’s incredibly rewarding to see these students grow and flourish,” she says. “From nervous newcomers to confident professionals, witnessing their transformation is truly inspiring.”