Buffett Retires: Babson Professors Highlight Lessons from a Historic Transition

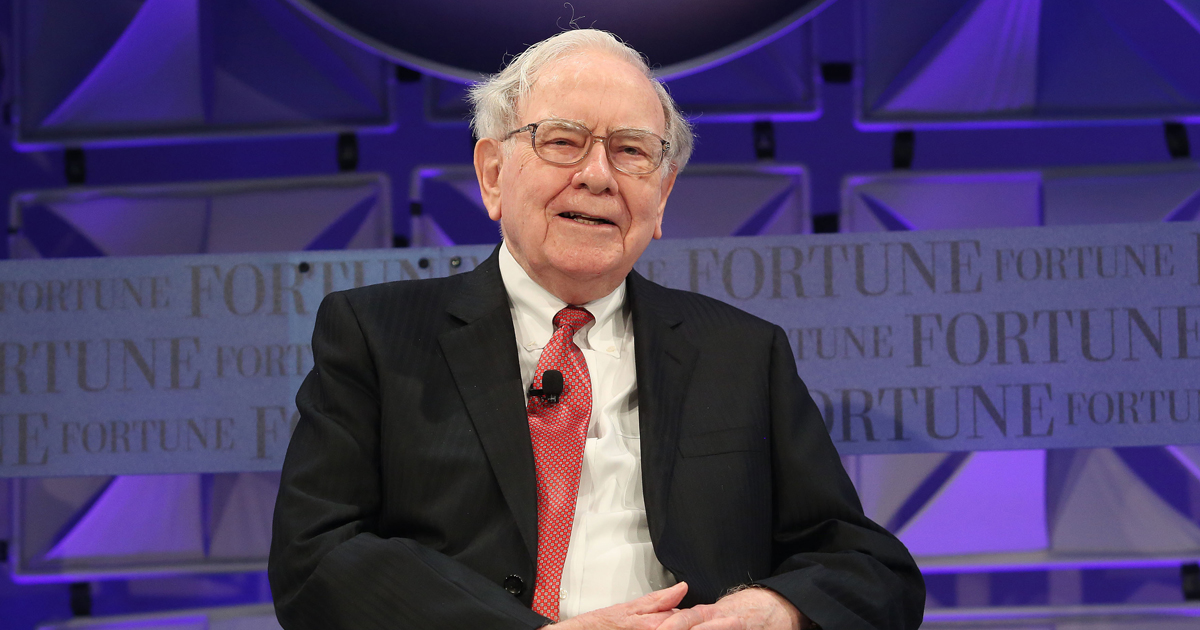

Legendary investor, skilled business leader, and oft-quoted philanthropist Berkshire Hathaway CEO Warren Buffett is a tough act to follow.

But, now that Buffet announced he will retire at the end of the year, vice chairman of operations Greg Abel faces the unenviable task of taking over after one of the most successful and popular leaders in modern history.

“This is a huge deal,” said Joseph Weintraub, a Babson College management professor and expert in leadership management. “A leadership change like this goes beyond a simple change of management process. It’s about finding the right person, preparing the organization, and preparing the general public.”

As CEO of Berkshire Hathaway, Buffett generated nearly 20 percent annualized returns for shareholders from 1965 to 2024, compared with 10.4 percent for the S&P 500 stock index. The announcement of his retirement rattled stockholders, despite Buffett’s vow that he will stay on as chair of the board.

In short, Buffett’s retirement is not just a milestone but also a master class in succession planning. Weintraub and Wendy Murphy, Babson’s associate dean of the Undergraduate School and a professor of management, shared their insights about the historic retirement.

Stability Before Innovation

“Sometimes we say, ‘Do all the change at once.’ But not now,” Murphy said. “This is a moment where you give people stability.” With Buffett’s departure happening in an environment already filled with economic and social uncertainty, Murphy emphasized the importance of managing ambiguity.

“Leaders reduce uncertainty. That’s what employees and investors want right now: reassurance that the Berkshire Hathaway they know is still intact.”

Both professors pointed to Buffett’s long-range planning—especially his early signaling of Abel as his successor—as a textbook example of thoughtful leadership transition.

“Succession planning doesn’t begin at the retirement party,” Weintraub said. “Buffett clearly prepared the public and internal teams well in advance. That level of communication and delegation builds confidence.”

No Need to Be a Clone

While Buffett’s successor faces monumental expectations, Weintraub warns against the trap of imitation. “Nobody’s going to step into those shoes and become Warren Buffett overnight,” he said. “And they shouldn’t try to. That status is earned over time.”

Instead, he advised new leaders to focus on forging a shared vision with stakeholders. “Leadership is not solitary,” he explained. “A new CEO needs to engage their internal community, partners, and investors in defining the next chapter—together.”

Murphy agreed. “Symbolic leadership matters. The new leader needs to be visible, attend employee events, and continue traditions,” she said. “But also articulate who they are and what they stand for, all while reinforcing the core culture.”

Leading Through the “Liminal Period”

Both professors stressed that transitions aren’t moments—they are periods.

“There’s a liminal space in leadership succession,” Weintraub said. “It’s a phase of uncertainty, but also of grace. New leaders are allowed some missteps, but they must overcommunicate and be highly present.”

Murphy pointed out the scrutiny that new leaders will face. “They’ll be under the microscope,” she said. “So even small actions—like showing up for employee recognition events—send huge signals.”

She also highlighted a unique opportunity for the outgoing leader to shape the transition. “Buffett can publicly articulate why Abel is the right person for the future,” she explained. “It’s powerful when a founder admits, ‘Greg brings strengths I don’t have, and that’s exactly what this company needs now.’ ”

Buffett started sowing those seeds in a recent Wall Street Journal article about his retirement.

“The difference in energy level and just how much [Abel] could accomplish in a 10-hour day compared to what I could accomplish in a 10-hour day—the difference became more and more dramatic,” Buffett said. “He just was so much more effective at getting things done, making changes in management where they were needed, helping people that needed help someplace, but just all kinds of ways.”

Culture Over Celebrity

For companies where the leader is better known than the brand, the transition is even more delicate. “Buffett is arguably more recognizable than Berkshire Hathaway,” Murphy said. “That creates a pop-cultural dynamic you don’t even see at Apple or Disney. But if the culture is strong, the company survives the personality.”

And that’s the central lesson: When iconic leaders step aside, a clear plan, steady communication, cultural continuity, and community involvement—not charisma—are what sustain an organization.

Or, as Weintraub puts it: “You don’t need another Warren Buffett. You need a leader who knows how to lead others through change—with humility, consistency, and purpose.”